The U.S. tax code is notoriously complex, and one area that often surprises retirees is how their Social Security benefits are taxed. Many people don’t realize that withdrawals from different types of retirement accounts can have a ripple effect on how much of their Social Security is considered taxable.

This guide will break down the rules step by step, explain how to calculate your taxable Social Security, and show how different retirement account withdrawals affect your overall tax picture. With careful planning, you can minimize taxes and avoid unpleasant surprises.

Watch on YouTube:

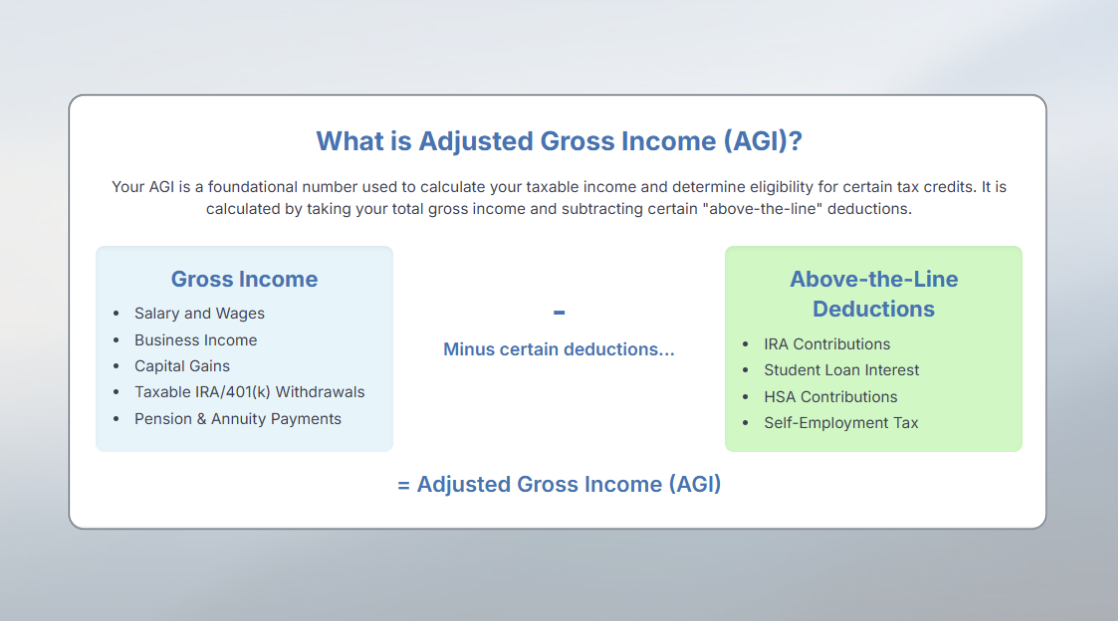

The first step in determining how much of your Social Security is taxable is calculating your adjusted gross income (AGI).

AGI starts with your gross income, which includes:

If you are retired, the most common components will be pensions, IRA withdrawals, and investment income.

From gross income, you subtract certain above-the-line deductions to arrive at AGI. These deductions are different from your standard or itemized deductions. Common examples include:

Once those adjustments are made, you have your AGI. This number plays a critical role in retirement planning because it feeds into the next calculation: provisional income.

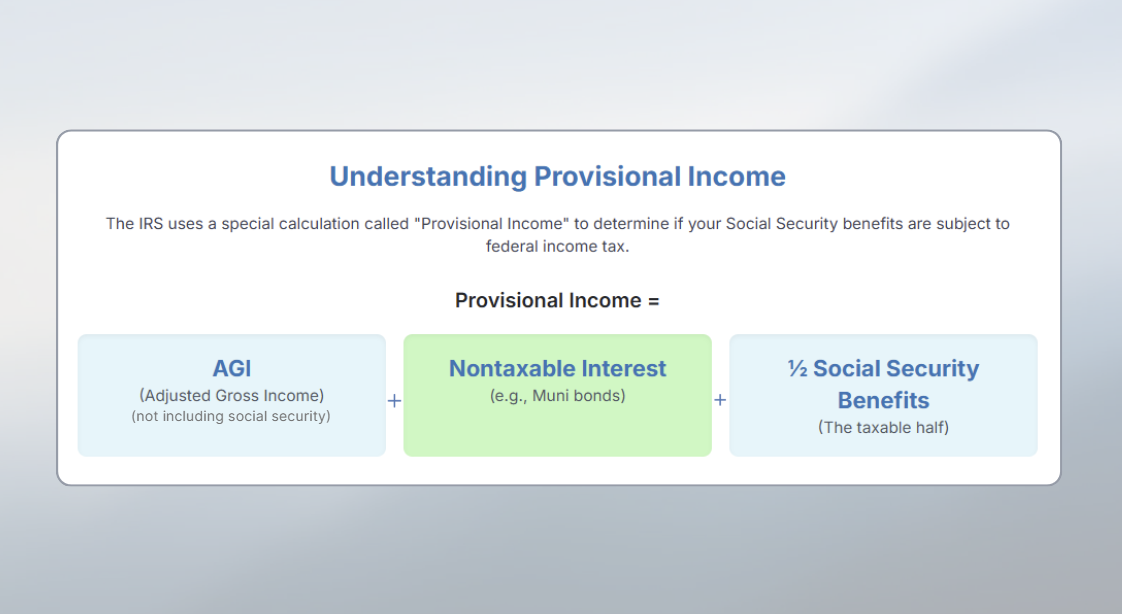

Provisional income is the IRS’s formula for deciding how much of your Social Security benefit is subject to income taxes. It combines three components:

The resulting number is your provisional income.

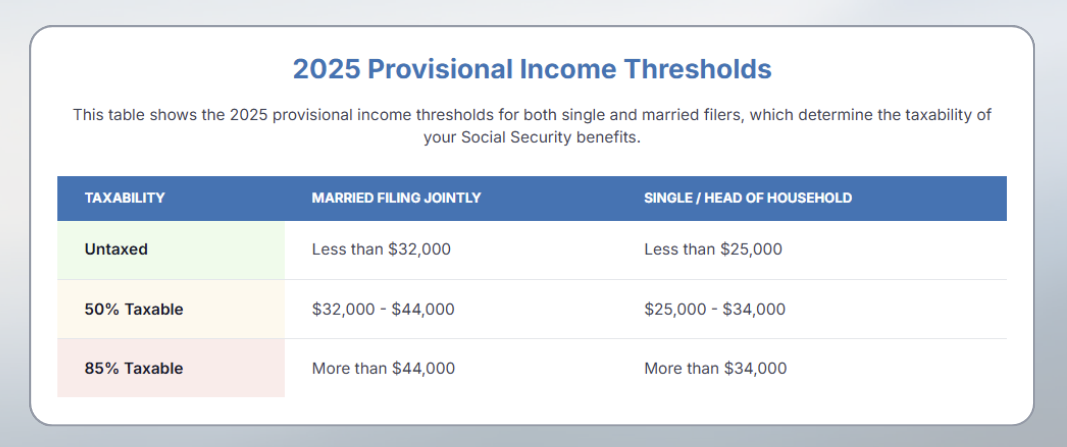

Once you have provisional income, the IRS applies thresholds to determine how much of your Social Security is taxable. These thresholds have not been adjusted for inflation since their introduction more than 40 years ago, which means more retirees are impacted each year.

It is important to note that not all of your benefits are automatically taxed at 85%. The system is progressive, with portions taxed at different rates depending on where you fall in the brackets.

Let’s consider a retired couple filing jointly:

Step 1: Calculate provisional income

Step 2: Apply brackets

Total taxable Social Security = $16,200.

This amount is added to AGI, giving them $46,200 in total taxable income before deductions.

In 2025, the standard deduction for married couples is $31,500. Couples over age 65 get an additional $1,600 per spouse, plus the new senior bonus deduction of $6,000 each under the recent One Big Beautiful Bill Act.

That means their total deduction is $46,700. Because deductions exceed their taxable income, their actual tax owed is zero.

This highlights an important point: just because some of your Social Security benefits are considered taxable does not mean you will actually pay taxes on them after deductions are applied.

Understanding how withdrawals from different types of retirement accounts affect Social Security is crucial for tax-efficient planning.

Traditional IRAs, 401(k)s, 403(b)s, and pensions all increase AGI dollar-for-dollar when you take withdrawals. This directly raises provisional income, which can increase the taxable portion of your Social Security.

Withdrawals from Roth IRAs, HSAs, and 529 plans do not increase AGI. This means they have no effect on Social Security taxation. These are the most tax-efficient sources of retirement income when trying to control taxes on benefits.

Brokerage accounts generate taxable income through dividends, interest, and capital gains. However, only the gains are taxable when you sell investments, not the return of your original cost basis. This makes taxable accounts moderately impactful on provisional income compared to tax-deferred accounts.

To see the differences in action, let’s revisit our retired couple and add $25,000 withdrawals from different accounts.

The U.S. tax system may be complicated, but with the right knowledge, you can use it to your advantage. By strategically choosing which accounts to withdraw from each year, retirees can minimize the taxation of Social Security benefits and keep more of their income.

A thoughtful retirement tax planning strategy should consider:

Taxes in retirement aren’t just about knowing your bracket—they are about understanding how different income sources interact. Social Security benefits, pensions, IRA withdrawals, and investment income all flow together into AGI and provisional income, which ultimately decide your tax liability.

With careful planning, retirees can avoid unnecessary taxes and maximize their income. The key is knowing how each withdrawal affects not just your AGI but also the taxation of your Social Security benefits.

Considering working with an advisor to maximize your retirement? We offer a free assessment to show you what it looks like to work with us. Start here.